Adding Tax Rates and Tax Rules

Overview

Tax Rates and Rules are used to apply taxes to Items and Offers. .

Tax rates are established and then associated with a Tax Rule that can be assigned to individual items.

Follow the steps below to learn how to add Tax Rates and Tax Rules to Items in Tabit Office

Adding Tax Rates

Tax Rates are shown on all financial reporting. Tax Rates are calculated on the PAD and then added to the Item sales price to collect appropriate taxes from the customer.

How to Add Tax Rates:

Login to Tabit Office with your Manager credentials.

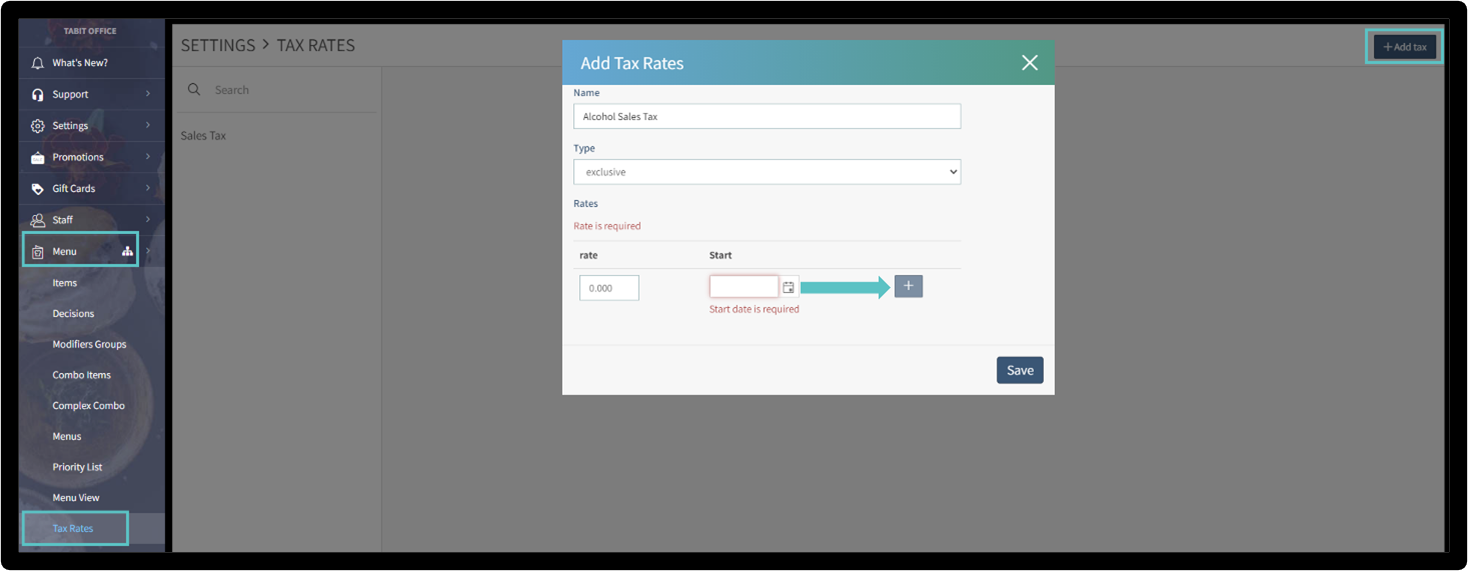

In Tabit Office, go to Menu > Tax Rates > Select +Add Tax

Enter the following information:

Name: Define the type of tax

Ex: State Tax, Local Tax, or Alcohol Tax

Type: Exclusive or Inclusive

Inclusive taxes are included in the published menu price

Exclusive taxes are added to the published menu price

Rate: Determined by relevant tax laws

Effective Date: Select today’s date

Select the + to add to the field before hitting Save

Adding Tax Rules

Tax Rules are built based on the added Tax Rates. Multiple Tax Rates can be combined into a single Tax Rate if they are the same type of Tax.

How to Add Tax Rules:

Login to Tabit Office with your Manager credentials.

In Tabit Office, go to Menu > Tax Rules > Add Rule+

Enter the following information:

Name: Enter in appropriate name – this name is typically displayed on the guest check

Tax Rules: Select appropriate rate(s)

Click the “+add” to add to the field before hitting Save.