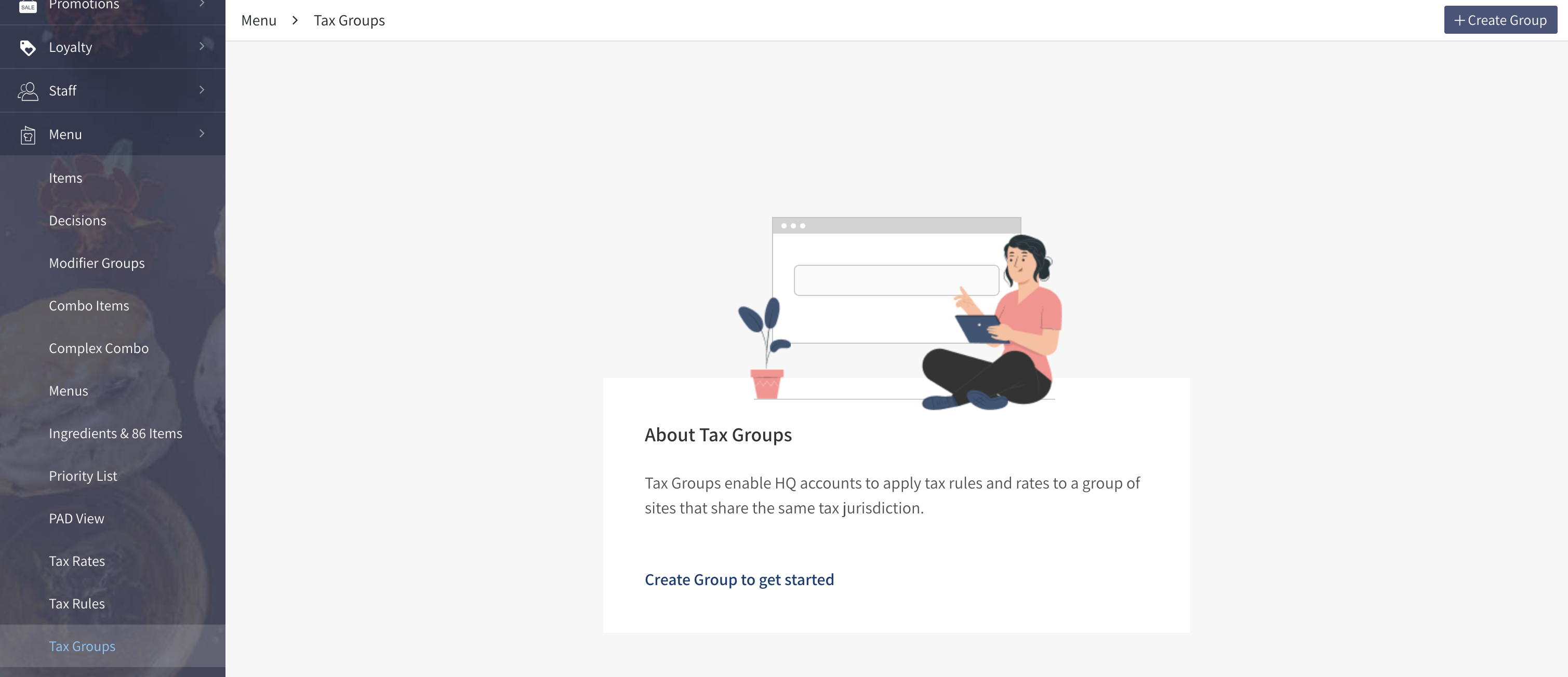

HQ Tax Groups

What are HQ Tax Groups?

Tax Groups enable HQ Sites to apply Tax Rules and Rates to a group of Sites that share the same tax jurisdiction. This enables HQ Sites who work with Master Item easier tax management from the HQ level.

Why Should I Use HQ Tax Groups?

HQ Tax Groups reduce time and mistakes when applying local, Site-level Tax Rules to new Master Items. They also provide consistency in Tax Rate reports.

Sites that are part of an HQ but do NOT work with Master Item are NOT eligible for participation in Tax Groups. For these Sites, all taxes must be configured locally.

Where do I Set up HQ Tax Groups?

The level on which HQ Tax Groups are set up is dependent upon where the site catalog is managed. There are three main scenarios:

If the HQ2 manages the catalog and the HQ1 is only used for reporting, the Site inherits the Catalog from the HQ2. The HQ2 should create and manage Tax Groups.

If the HQ2 is only used for reporting, and the HQ1 manages the catalog, the Site inherits the Catalog from the HQ1. HQ1 should create and manage Tax Groups.

For HQ Sites with only two levels, everything is managed on the HQ1 level.

Sites assigned to Tax Groups on the HQ level are now blocked from adding their own Tax Rates and Rules, and will only be able to view their Site's Tax Rates and Rules but not add any new ones or edit the existing ones.

How do I Configure HQ Tax Groups?

Learn how to configure HQ Tax Groups here.

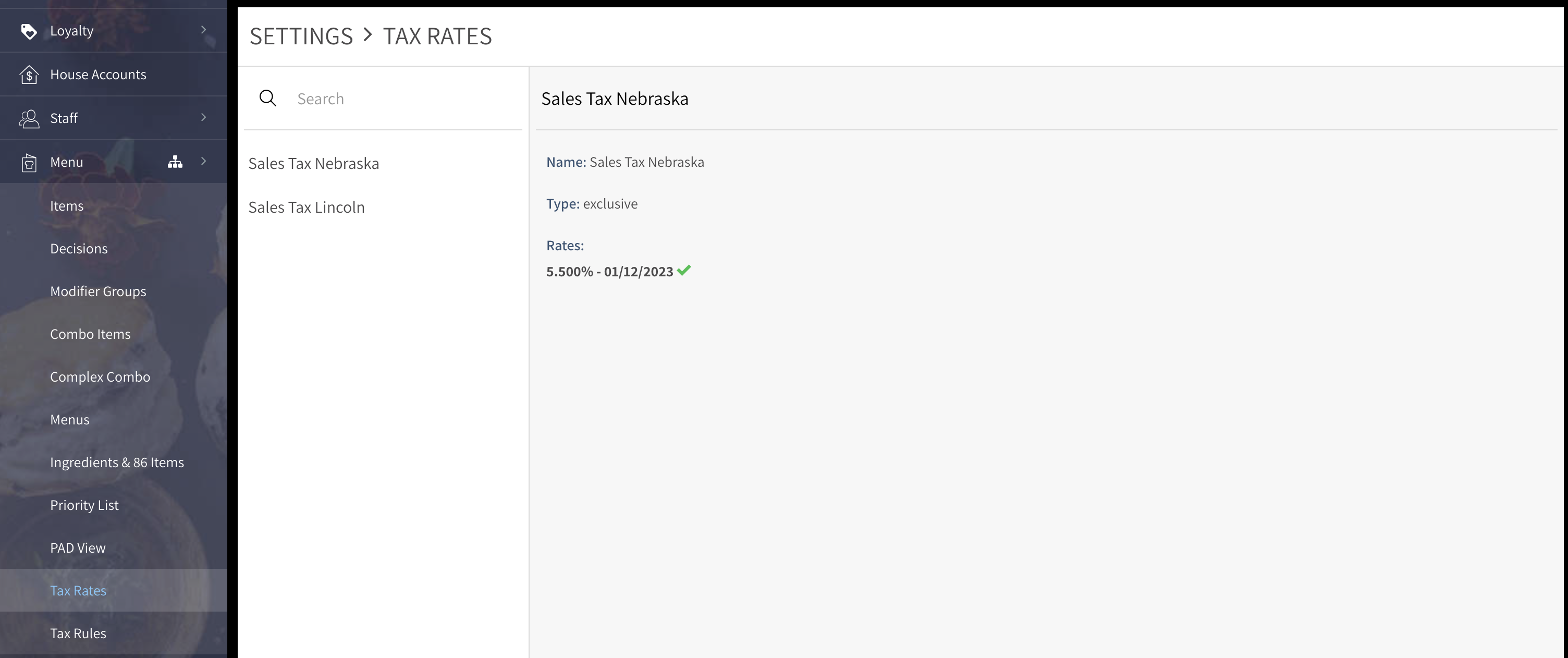

What if the Site Already has Tax Rates and Rules Set up?

If the Site already has Tax Rates and Rules set up, please review Migrating a Site to HQ Tax Groups before continuing.