Release Notes - October 8, 2024

PAD V10.5.1, OFC V8.8.8

Enhanced Credit Surcharge Solution

Tabit introduced a new, more accurate and compliant way to handle credit processing fees, that replaces the previous credit fee and cash discount model.

Before: Restaurants could only apply credit surcharges to the ordered items, which left them covering fees for other payment components, such as taxes and additional fees.

Now: The new solution offers the following key benefits and improvements -

Card Identification: The system now identifies whether the card is a debit or credit card, ensuring that debit cards ado not have credit surcharges applied, in compliance with regulations.

Comprehensive Fee Calculation: Credit surcharges are now calculated based on the total order, not just the subtotal. This includes auto gratuity, any other fees, and taxes, and does not include tips.

Tax Rule Application: You can apply credit surcharge tax rules, both exclusive and inclusive.

Payment Method Adjustments: The credit surcharge is automatically removed from cash, debit, and other non-credit payment methods, eliminating the need for cash discounts.

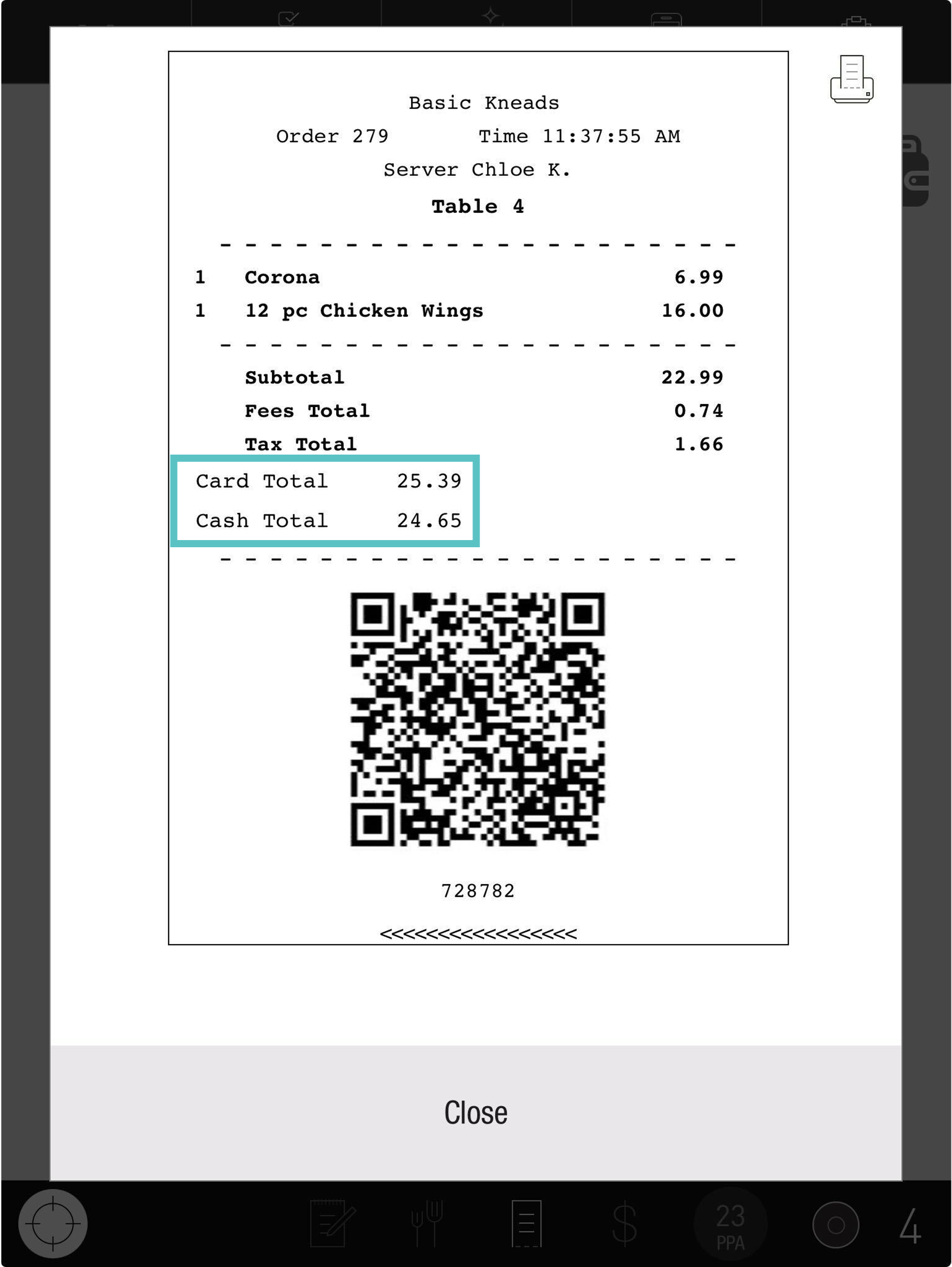

Dual Totals: A card total and a cash total is displayed on all PAD views and documents, enhancing transparency.

Accurate Reporting: Reports will now show the actual fees charged, rather than reflecting cash discounts.

Refund Transactions: Credit surcharge can be refunded only if it was initially applied to the payment

Please refer to the related articles below:

Updates to the new Tabit Shift configuration page

The Tabit Shift configuration page has been updated, making it easier to understand and providing more control over certain settings